Generative AI In Insurance Market Competition Analysis 2025: How Players Are Shaping Growth

The Business Research Company's Generative AI In Insurance Global Market Report 2025 – Market Size, Trends, And Global Forecast 2025-2034

LONDON, GREATER LONDON, UNITED KINGDOM, January 7, 2026 /EINPresswire.com/ -- The Generative AI In Insurance market is dominated by a mix of global technology leaders and regional AI innovators. Companies are focusing on advanced generative AI solutions, cloud-based platforms for insurance operations, and robust governance frameworks to strengthen market presence and ensure compliance. Understanding the competitive landscape is key for stakeholders seeking growth opportunities, strategic partnerships, and technological differentiation in the rapidly evolving insurance sector.

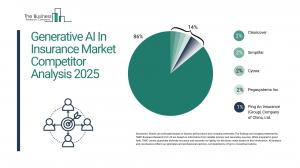

Which Market Player Is Leading the Generative AI In Insurance Market?

According to our research, Clearcover led global sales in 2024 with a 2% market share. The company partially involved in the generative AI in insurance market growth provides software a comprehensive suite of generative AI-powered products and services for the insurance sector, focusing primarily on streamlining auto claims processing, enhancing customer service, and automating underwriting tasks. Key offerings include an AI claims tool that uses large language models for real-time digital statement collection at First Notice of Loss (FNOL).

How Concentrated Is the Generative AI In Insurance Market?

The market is fragmented, with the top 10 players accounting for 15% of total market revenue in 2024. This level of fragmentation reflects the industry’s high entry barriers driven by complex technical requirements, stringent regulatory frameworks, and enterprise demand for trusted, compliant, and scalable AI insurance solutions. Leading vendors such as Clearcover, Simplifai, Cytora, Pegasystems Inc., Ping An Insurance (Group) Company of China, Ltd., Hiscox Group, Zurich Insurance Group, QBE Insurance Group Limited, Tractable Ltd., and Swiss Re dominate through advanced generative AI platforms, integrated insurance workflows, and established client trust, while smaller firms serve niche markets and specialized use cases. As adoption of generative AI in insurance accelerates, consolidation and strategic partnerships are expected to further strengthen the dominance of major players.

• Leading companies include:

o Clearcover (2%)

o Simplifai (2%)

o Cytora (2%)

o Pegasystems Inc. (2%)

o Ping An Insurance (Group) Company of China, Ltd. (1%)

o Hiscox Group (1%)

o Zurich Insurance Group (1%)

o QBE Insurance Group Limited (1%)

o Tractable Ltd. (1%)

o Swiss Re (1%)

Request a free sample of the Generative AI In Insurance Market report:

https://www.thebusinessresearchcompany.com/sample_request?id=15185&type=smp

Which Companies Are Leading Across Different Regions?

• North America: Intact Financial Corporation, Sun Life Financial Inc. (Canada), Planck Holdings Inc., Clearcover Insurance, Inc., Verisk Analytics, Inc., AXA XL, CGI Inc., Manulife Financial Corporation (Canada), Coherent Canada Inc., Cyence Inc., Lemonade, Inc., Progressive Corporation, and Allstate Corporation are leading companies in this region.

• Asia Pacific: QBE Insurance Group Limited, Gallagher Bassett Services, Inc., Ping An Insurance (Group) Company of China, Ltd., Tokio Marine Holdings, Inc., Oona Insurance, FingerMotion, Inc., and ZhongAn Online P&C Insurance Co., Ltd., and more are leading companies in this region.

• Western Europe: AXA S.A., Assicurazioni Generali S.p.A., Munich Reinsurance Company, Zurich Insurance Group, Earnix Ltd., and Allianz Trade are leading companies in this region.

• Eastern Europe: Comarch S.A., Sollers Consulting, UiPath Inc., Generali Romania, Yandex N.V., Sberbank of Russia (Sber), Tinkoff Bank, Sigma Software Group, and Luxoft Holding, Inc. are leading companies in this region.

• South America: Guidewire Software, Inc. (Brazil), Zetta, Seguros Falabella S.A., SURA S.A., and Pacífico Seguros S.A. are leading companies in this region.

What Are the Major Competitive Trends in the Market?

• Intelligence Platforms is transforming operational efficiency, improve risk assessment, and streamline claims and underwriting processes across the insurance value chain.

• Example: Perfios Software Solutions Private Ltd. Next-Generation GenAI-Powered Intelligence Stack (July 2025) assigns banking, financial services, and insurance (BFSI) sector, featuring four AI-driven solutions, including Compass, an internal chatbot assistant, Data Intelligence Bridge, an advanced document digitization and orchestration engine, Prism, an API gateway with generative AI capabilities, and a medical insurance claim adjudication solution for automated claims processing and fraud detection.

• These innovations leveraging large language models, machine learning, and vision-language models, the platform modernizes legacy financial operations, enabling up to threefold productivity gains.

Which Strategies Are Companies Adopting to Stay Ahead?

• Launching AI-driven underwriting and claims automation to accelerate decision-making and improve accuracy

• Enhancing personalized insurance products and dynamic pricing models using generative AI insights

• Focusing on data governance, compliance, and AI risk management frameworks to ensure regulatory adherence

• Leveraging cloud-based generative AI platforms for scalable deployment, real-time analytics, and improved customer engagement

Access the detailed Generative AI In Insurance Market report here:

https://www.thebusinessresearchcompany.com/report/generative-ai-in-insurance-global-market-report

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more.

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.