Plastic Resin Market Size to Worth USD 1,384.76 Billion by 2035 - Exclusive Report by Towards Chemical and Materials

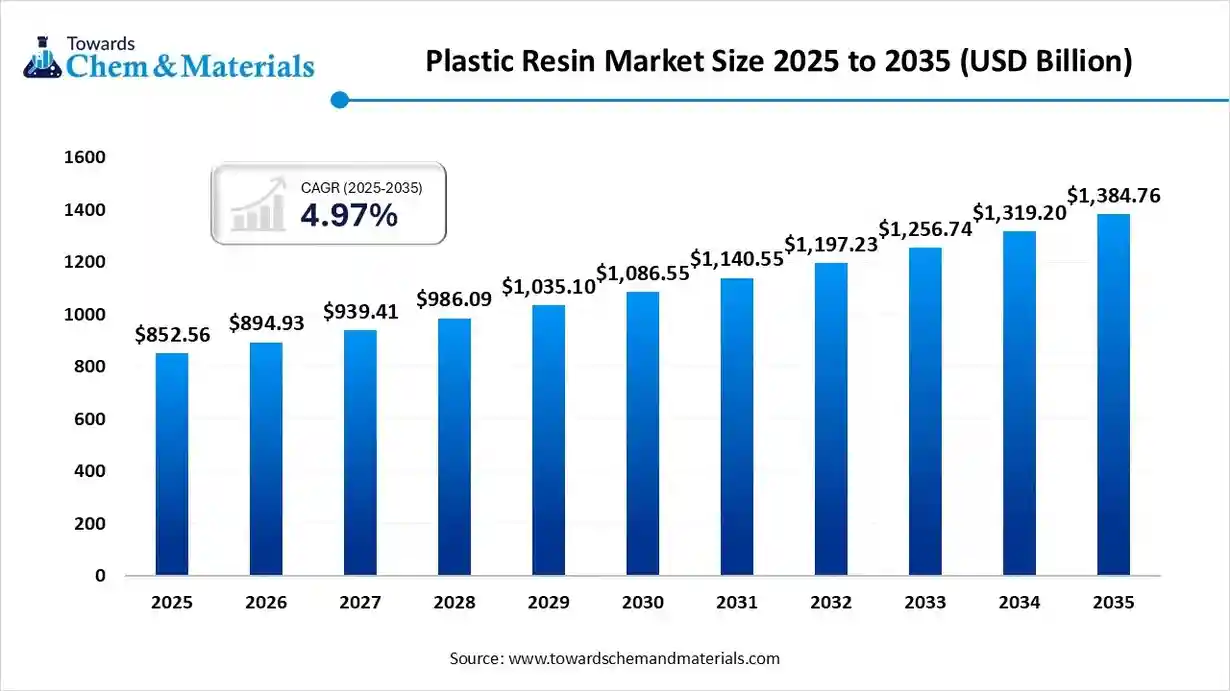

According to Towards Chemical and Materials, the global plastic resin market size was estimated at USD 852.56 billion in 2025 and is expected to be worth around USD 1,384.76 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.97% over the forecast period from 2026 to 2035.

Ottawa, Dec. 16, 2025 (GLOBE NEWSWIRE) -- The global plastic resin market size was estimated at USD 852.56 billion in 2025 and is predicted to increase from USD 894.93 billion in 2026 and is projected to reach around USD 1,384.76 billion by 2035, The market is expanding at a CAGR of 4.97% between 2026 and 2035. Asia Pacific dominated the plastic resin market with a market share of 4.99% the global market in 2025. Rising demand for lightweight and durable materials in packaging and automotive applications is a key growth factor driving the plastic resin market. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6070

What is Plastic Resin?

The plastic resin market encompasses synthetic and semi-synthetic polymer materials used as core raw inputs across industries such as packaging, automotive construction, electronics, and consumer goods. Its growth is supported by the wide use of lightweight, durable, and versatile materials that meet evolving performance and design requirements. The market is influenced by sustainability initiatives, increasing adoption of recycled and bio-based resins, and continuous advancements in material innovation and processing technologies, reflecting changing industrial and environmental priorities.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Plastic Resin Market Report Highlights

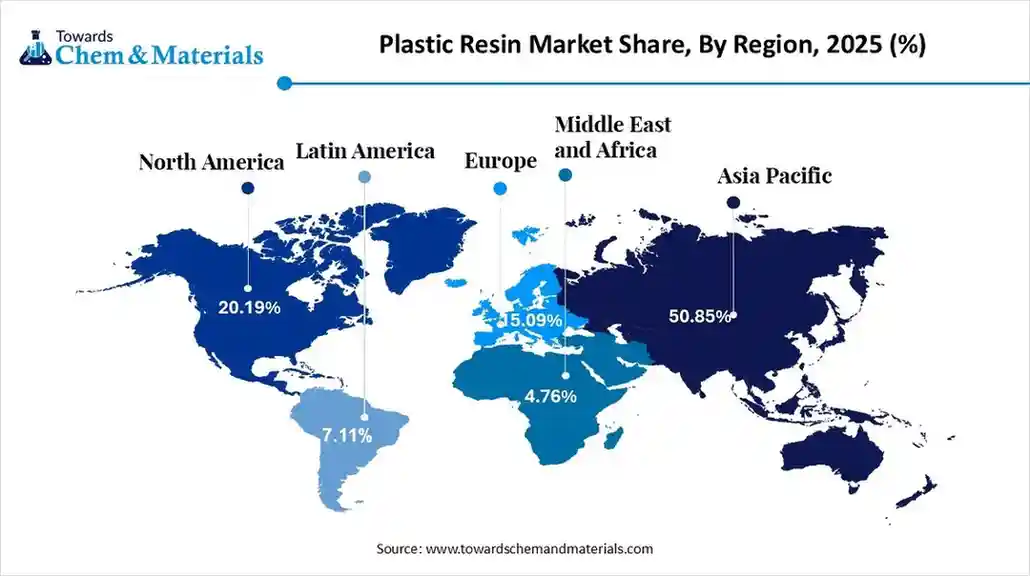

- By region, Asia Pacific led the plastic resin market with the largest revenue share of over 50.85% in 2025.

- By resin type/polymer type, the commodity plastics segment led the market with the largest revenue share of 31.19% in 2025.

- By application, the packaging segment led the market with the largest revenue share of 38.14% in 2025.

- By source/feedstock, the fossil fuel-based (conventional) resins segment accounted for the largest revenue share of 91.12% in 2025.

- By process type/structure, the thermoplastics segment dominated with the largest revenue share of 85.78% in 2025.

- By manufacturing process, the injection molding segment dominated the market and accounted for the largest revenue share of 41.10% in 2025.

How Many Types of Plastic Resin Are There?

When exploring plastic resin types, it’s important to look at both synthetic and natural resins, each valued in various industries for their distinct properties, such as strength, flexibility, and impact resistance. Here’s a closer look at some common types of plastic resins:

Polyethylene (PE), which includes High-Density (HDPE) and Low-Density (LDPE) variants, is the most commonly used plastic resin. It’s widely used in food packaging, bottles, and grocery bags, thanks to its excellent resistance to chemicals and moisture, making it ideal for packaging applications.

Polypropylene (PP) shares many features with polyethylene but has a higher melting point, making it suitable for applications needing greater heat resistance. It’s often used in microwave-safe containers, automotive parts, and carpet fibers.

Polyvinyl Chloride (PVC) is a versatile and durable resin known for its stability and fire resistance. Commonly, you’ll find PVC used in pipes, windows, and vinyl flooring.

Polyethylene Terephthalate (PET) is a clear, strong plastic resin commonly used in food and beverage packaging, such as plastic bottles and food trays. PET’s excellent chemical resistance and low gas permeability help maintain the freshness of packaged products.

Polystyrene (PS) comes in both rigid and foam forms and is widely used in items like disposable cutlery, yogurt cups, and insulation.

Polymethyl Methacrylate (PMMA), also known as acrylic or Plexiglas, is a transparent, lightweight resin often used as an alternative to glass. Its durability and shatter resistance make it ideal for applications like window panes and protective screens.

In addition to these synthetic resins, naturally occurring resins like shellac, amber, and rosin also exist. Sourced from plants and insects, these resins offer adhesive properties and are often used in varnishes and sealing waxes.

With a broad understanding of these resin types, you can more easily navigate the world of plastics and their various applications. Each resin has distinct properties, so carefully considering these characteristics will help in selecting the right materials for your projects.

How is Resin Made?

The process of creating plastic resins begins with heating hydrocarbons in a “cracking process” to break down larger molecules into ethylene, propylene, and other hydrocarbons. The temperature used in cracking influences the amount of ethylene produced.

After cracking, these chemicals are synthesized into polymer chains. Various polymers are combined to create plastic resins with properties suited for specific applications. Once produced, plastic resins serve as the foundation for a wide range of plastic products.

Here’s a breakdown of the plastic resin manufacturing process:

Step 1: Petroleum Extraction

Petroleum is extracted through drilling and sent to an oil refinery for further processing.

Step 2: Creating Petrochemicals

Refining crude oil produces petrochemicals, such as ethane and propane.

Step 3: Cracking

Ethane and propane undergo cracking, where heat is applied to create smaller hydrocarbons, including ethylene and propylene.

Step 4: Adding a Catalyst

A catalyst is added in a reactor to form a polymer powder called “fluff,” which is blended with various additives depending on the type of plastic being produced.

Step 5: Melting

The polymer is then melted using an extruder.

Step 6: Shaping

After cooling, the melted polymer is cut and shaped into plastic pellets, which are later used in extrusion, injection molding, and blow molding, among other manufacturing methods.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6070

Plastic Resin Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 894.93 Billion |

| Revenue forecast in 2035 | USD 1,384.76 Billion |

| Growth rate | CAGR of 4.97% from 2026 to 2035 |

| Base year for estimation | 2023 |

| Historical data | 2018 - 2025 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Volume in kilotons, revenue in USD million, and CAGR from 2026 to 2035 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Product, Application, and Region |

| Regional scope | North America, Europe, China, Asia, Pacific, Central & South America, Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France; Italy; Poland, Spain, India, Japan, Thailand, Malaysia, Indonesia, Vietnam, Singapore, Philippines, Brazil, Argentina, Saudi Arabia; UAE; Oman |

| Key companies profiled | BASF SE; Dow, Inc.; SABIC; Evonik Industries AG; Sumitomo Chemical; Arkema; Celanese Corp.; Eastman Chemical Company; Chevron Phillips Chemical Co., LLC; Lotte Chemical Corp.; Covestro AG; Toray Industries, Inc.; Teijin Ltd. |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Private Industry Investments for Plastic Resin:

- Adani Group: This company is developing a large, $4 billion PVC plant in Mundra, India, with the first phase expected to be completed by December 2026.

- Reliance Industries: The firm is actively preparing for a 1 million-tonne polyester capacity add-on and accelerating its PVC capacity expansion.

- Rishiroop Limited: The company is investing approximately ₹35 crore to expand its existing polymer blend manufacturing capacity and establish a new plastics compounding business vertical.

- All Time Plastics: This manufacturer is currently expanding its production capacity at its Khatalwada plant by installing additional machinery, aiming to increase total capacity to 52,500 metric tons by FY27.

-

Foxconn (FTC USA): Its new $173 million facility in Kentucky will include fully in-house services, incorporating plastic injection molding capabilities.

What Are the Major Trends in the Plastic Resin Market?

- There is a growing emphasis on sustainability and the adoption of recycled and bio-based resins to meet environmental goals and regulatory pressures.

- Ongoing technological innovations in materials and processing that improve performance and expand application potential.

- Increasing demand from end-use industries such as packaging, automotive, and construction for lightweight and versatile resin markets.

- Rising market consolidation and strategic collaborations as companies strengthen capabilities and global supply chains.

How Does AI Influence the Growth of the Plastic Resin Industry in 2025?

AI influencers will drive the growth of the plastic resin industry in 2025 by enhancing efficiency and innovation across production and supply chains. Intelligent systems optimise manufacturing operations, reducing waste and energy use while improving quality control and consistency in resin production. AI-powered predictive analytics help manufacturers anticipate demand and manage inventory more effectively, smoothing supply fluctuations and lowering costs. In design and formulation, machine learning accelerates the development of new resin grades with tailored properties and packaging.

Market Opportunity

Can Advanced Recycling Improve Resin Availability?

Advanced recycling technologies are creating opportunities to convert hard-to-recycle plastics into usable resin materials. This supports circular material use and reduces dependence on virgin feedstocks.

Are Bio-Based Resins Shaping Future Material Choices?

Rising interest in bio-based and sustainable resins opens opportunities for manufacturers to align with environmental goals and consumer preferences. These materials support lower environmental impact across product lifecycles.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6070

Plastic Resin Market Segmentation Insights

Resin Type/Polymer Type Insights:

Why Commodity Plastics Segment Dominated the Plastic Resin Market in 2025?

The commodity plastics segment dominated the plastic resin market due to its broad applicability, cost efficiency, and ease of processing across multiple industries. This segment benefits from strong demand in everyday applications such as packaging, household products, and consumer goods, where performance consistency and affordability remain critical. Widespread availability of raw materials and well-established manufacturing infrastructure further support its strong presence.

The engineering plastics segment is set to experience the fastest growth in the market as industries increasingly require materials with enhanced strength, heat resistance, and durability. This segment is gaining traction in automotive, electronics, and industrial applications where performance requirements are more demanding.

Application/End Use Industry Insights:

Which Application Segment Held the Dominating Share of the Plastic Resin Market in 2025?

The packaging segment dominated the market as it remains a major consumer of plastic resins for flexible and rigid packaging solutions. The segment benefits from continuous demand for food, beverage, and consumer product packaging that prioritises durability, protection, and convenience. Growth in e-commerce and changing consumption patterns further reinforce the need for efficient packaging materials.

The medical & healthcare segment is projected to grow at the fastest pace in the market due to increasing reliance on safe, lightweight, and sterile materials. The market is due to increasing reliance on safe, lightweight, and sterile materials. Plastic resins play a crucial role in medical devices, diagnostic equipment, and healthcare packaging, where precision and reliability are essential.

Source/Feedstock Insights:

How Fossil Fuel-Based Resins Segment Dominates the Plastic Resin Market In 2025?

The fossil fuel-based resins dominated the market because of their established supply chains, consistent quality, and compatibility with existing processing technologies. These resins continue to be widely used across industries due to predictable performance and large-scale production capabilities. Their strong presence is supported by mature petrochemical infrastructure and global manufacturing networks.

Recycled resins are anticipated to grow rapidly in the plastic resin market as sustainability becomes a priority across industries. Increasing focus on circular economy practices and waste reduction is encouraging manufacturers to integrate recycled materials into production processes. Improvements in recycling technologies are also enhancing material quality and usability.

Process Type/Structure Insights:

Which Process Type/Structure Segment Leads the Plastic Resin Market?

The thermoplastics segment dominated the market due to its reusability, ease of moulding, and adaptability across diverse applications. These materials can be reshaped multiple times without losing core properties, making them suitable for mass production and recycling initiatives. Their compatibility with various manufacturing techniques supports extensive use in packaging, automotive, and consumer products.

The thermosets are expected to grow at a faster pace in the market as demand rises for materials with superior thermal stability and structural integrity. These resins are increasingly used in applications requiring long-term durability, such as construction and electrical components. Their resistance to heat and chemical exposure makes them suitable for specialised uses.

Manufacturing Process Insights:

What Made the Injection Molding Segment Dominate the Plastic Resin Market?

The injection molding dominates the market due to its efficiency, precision, and ability to produce complex components at scale. This process supports high production consistency and is widely adopted across automotive, packaging, and consumer goods manufacturing. Its compatibility with a wide range of resin types further strengthens its role.

Rotational molding is projected to expand rapidly in the market as demand increases for hollow and durable plastic products. The process offers uniform wall thickness and design flexibility, making it suitable for storage containers and industrial applications. Lower material waste and improved design freedom are also supporting adoption.

➤ Contact Us: sales@towardschemandmaterials.com | ☎ +1 804 441 9344

Regional Insights

How Does Asia Pacific Dominate the Plastic Resin Market?

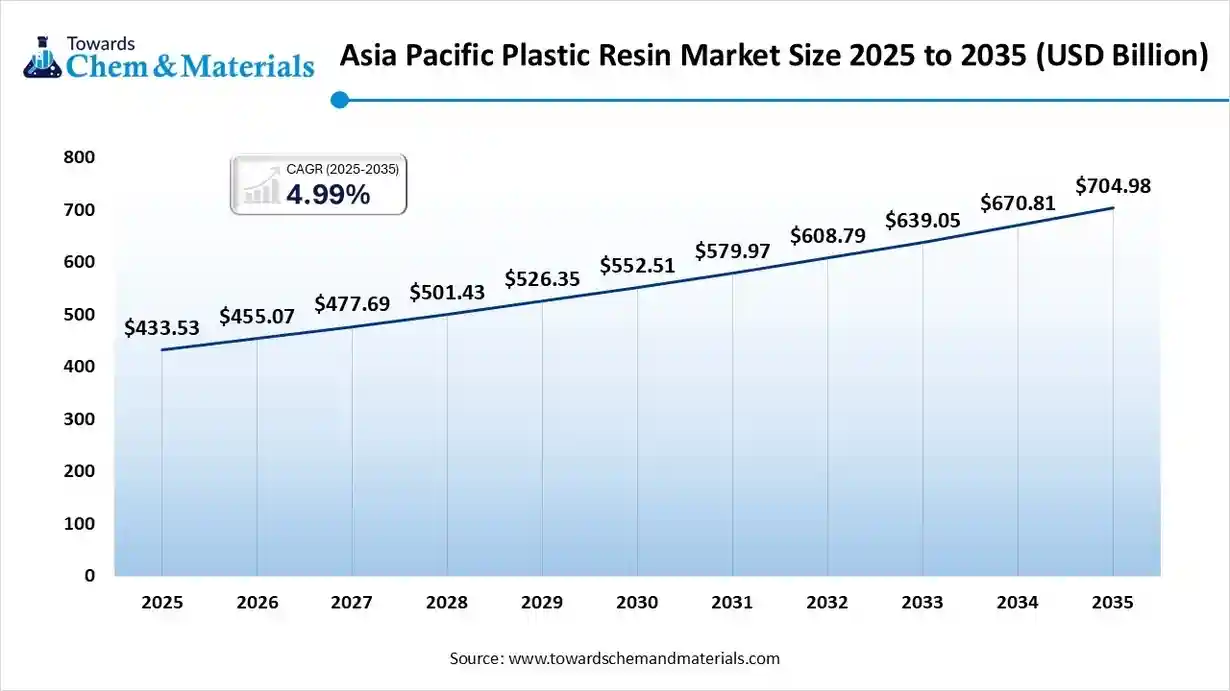

The Asia Pacific plastic resin market size was valued at USD 433.53 billion in 2025 and is expected to reach USD 704.98 billion by 2035, growing at a CAGR of 4.99% from 2026 to 2035.

Asia Pacific holds the largest share of the global market, driven by rapid industrialisation, expanding manufacturing sectors, and large consumer markets that rely heavily on plastics for packaging, automotive, electronics, and construction applications. The region benefits from extensive production capacity and lower manufacturing costs, making it a global hub for both resin production and downstream plastic processing.

Strong growth in industrial output, urbanisation, and infrastructure development continues to sustain high demand for diverse resin types across multiple end-use industries. Furthermore, investments in recycling infrastructure and emerging sustainable materials support long-term market expansion in the region.

China Plastic Resin Market Trends

China stands out within Asia Pacific as a principal contributor to the region’s market due to its substantial production base, well-developed petrochemical and plastics manufacturing infrastructure, and strong domestic consumption across packaging, automotive, and electronics sectors. The country’s focus on improving recycling infrastructure and advancing high-performance speciality plastics further strengthens its influence in the market.

How is North America Emerging as the Fastest-Growing Plastic Resin Industry?

North America is showing rapid expansion in the market due to strong and diversified demand from the packaging, automotive, construction, medical devices, and consumer goods sectors. The region’s focus on sustainability initiatives, chemical recycling, and development of high-performance polymers is encouraging innovation and investment in advanced resin technologies. Mature infrastructure and access to key petrochemical feedstock also support growth, enabling manufacturers to respond quickly to evolving industrial needs while strengthening resin supply chains.

U.S. Plastic Resin Market Trends

The U.S. plays a central role in North America’s market because of its extensive petrochemical infrastructure, significant production capacity, and strong downstream industries that use resins in diverse applications. Lightweighting trends in automotive and transportation, along with rising use of plastics in medical devices and consumer goods, continue to support resin consumption. Polyethylene and polypropylene remain dominant due to their versatility, cost-effectiveness, and wide application in flexible and rigid packaging.

Top Companies in the Plastic Resin Market & Their Offerings:

- Sinopec: Produces high-volume commodity resins including polyethylene, polypropylene, and PVC for diverse industrial uses.

- Formosa Plastics: Specializes in vertically integrated production of PVC, polyethylene, and polypropylene for construction and packaging.

- Mitsubishi Chemical: Offers a diverse portfolio of specialty engineering resins, including acrylics, polycarbonates, and bio-based polymers.

- Lotte Chemical: Manufactures high-performance resins like ABS, polycarbonate, and polypropylene for the automotive and electronics sectors.

- Chevron Phillips Chemical: Focuses on the production of high-density polyethylene and specialty alpha-olefins for rigid packaging and piping.

- Sumitomo Chemical: Supplies polyolefins and advanced engineering plastics, such as liquid crystal polymers, for electronic applications.

- DuPont: Specializes in high-performance engineering polymers designed for extreme environments in aerospace and healthcare.

- TotalEnergies: Produces polyethylene and polypropylene with a strategic focus on recycled and bio-circular resin grades.

- Braskem: Leads in polyolefin production, featuring a prominent line of bio-based polyethylene derived from sugarcane.

- Celanese: Primarily provides high-performance engineering resins, specifically polyoxymethylene (POM) and thermoplastic polyesters.

- Covestro: Focuses on premium polycarbonate resins and high-tech polymer materials for the automotive and construction industries.

- LG Chem: Offers a broad range of resins including ABS, polycarbonate, and polyolefins for high-tech industrial applications.

- Toray Industries: Specializes in performance-critical engineering plastics like nylon, PBT, and polyphenylene sulfide (PPS).

- Evonik Industries: Concentrates on high-performance specialty polymers, such as PEEK and transparent polyamides, for medical and technical use.

More Insights in Towards Chemical and Materials:

- Resin Market Size to Surpass USD 1,156.71 Billion by 2035

- Phenolic Resins Market Size to Hit USD 27.17 Billion by 2034

- Epoxy Resins Market Size to Reach USD 28.66 Billion by 2034

- Biomaterials Market Size to Surge USD 526.63 Billion by 2034

- Polymer Denture Material Market Size to Hit USD 4.11 Billion by 2034

- Ion-Conductive Polymers Market Size to Hit USD 8.75 Bn by 2035

- Stainless Steel-Filled Polymer Filaments Market Size to Hit USD 157.82 Mn by 2035

- Smart Textile Polymers Market Size to Hit USD 9.63 Million by 2035

- Biopolymer Coatings Market Size to Reach USD 109.08 Bn by 2035

- Polymer Coated Fabrics Market Size to Hit USD 40.13 Bn by 2035

- Polymer Foam Market Size to Surge USD 273.58 billion by 2034

- Liquid Crystal Polymers Market Size to Hit USD 6.73 Billion by 2034

- Polymers Market Size to Reach USD 1,351.59 Billion by 2034

- Bio-Based Polymers Market Size to Hit USD 58.36 Billion by 2034

- Recycled Engineering Plastics Market Size to Hit USD 7.89 Billion by 2034

- Mechanical Recycling of Plastics Market Size to Surge USD 92.86 Bn by 2034

- Recycled Plastic Pipes Market Size to Hit USD 20.08 Billion by 2034

- Carbon Fiber Reinforced Plastic (CFRP) Market Size to Surge USD 48.08 Bn by 2034

- Commodity Plastics Market Size to Hit USD 666.76 Billion by 2034

- Corrugated Plastic Sheets Market Size to Reach USD 3.05 Bn by 2034

- Biodegradable Plastics Market Size to Reach USD 91.26 Billion by 2034

- Sustainable Plastics Market Size to Hit USD 1,448.23 Bn by 2034

- Recycled Plastics Market Size to Surpass USD 190.25 Billion by 2035

- Circular Plastics Market Size to Hit USD 182.21 Billion by 2034

- Polyester Resin Dispersion Market Size to Hit USD 14.70 Bn by 2034

- Recycled Plastics In Green Building Materials Market Size to Reach USD 12.24 Bn by 2034

- Transparent Plastics Market Size to Hit USD 245.19 Bn by 2034

- Engineering Plastics Market Size to Hit USD 312.88 Bn by 2034

- Biopharma Plastic Market Size to Reach USD 6.68 Billion in 2025

- Biobased Biodegradable Plastic Market Size to Reach 14.80 bn by 2034

- High Performance Plastics Market Size to Hit USD 29.36 Bn by 2025

- Coating Resins Market - Current Status and Future Innovations

Plastic Resin Market Top Key Companies:

- BASF SE

- SABIC

- Dow

- DuPont

- Evonik Industries AG

- Sumitomo Chemical Co., Ltd.

- Celanese Corporation

- Eastman Chemical Company

- Chevron Phillips Chemical Co., LLC

- LOTTE Chemical Corporation

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- TORAY INDUSTRIES, INC.

- MITSUI & CO. LTD

- TEIJIN LIMITED

- LG Chem

- Avient Corporation

Recent Developments

- In December 2025, Formerra announced a partnership to distribute Techmer PM’s color masterbatches, high-performance additives, and pre-coloured compounds across North America, expanding access to advanced resin solutions for industries like automotive, medical, packaging, and consumer goods. This collaboration enhances product portfolios and supports more tailored resin applications.

- In July 2025, Dow recently introduced INNATE TF 220 resin, a new high-performance polyethylene designed for recyclable flexible packaging applications, improving durability and supporting circularity efforts. This innovation reinforces the market’s pivot toward sustainable, recyclable plastic solutions.

Plastic Resin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Plastic Resin Market

By Resin Type/Polymer Type

- Commodity Plastics (Bulk Resins)

- Polyethylene (PE)

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Engineering Plastics (E-Plastics)

- Polycarbonate (PC)

- Polyamide (PA) / Nylon

- Acrylonitrile Butadiene Styrene (ABS)

- Polyoxymethylene (POM) / Acetal

- Polybutylene Terephthalate (PBT)

- Polymethyl Methacrylate (PMMA)

- Modified Polyphenylene Ether (PPE)

- Super Engineering Plastics (High-Performance)

- Polyether Ether Ketone (PEEK)

- Polysulfone (PSU) / Polyethersulfone (PES)

- Polyphenylene Sulfide (PPS)

- Liquid Crystal Polymer (LCP)

- Polyimide (PI)

By Source/Feedstock

- Fossil Fuel-Based (Conventional) Resins

- Petroleum-Based

- Natural Gas-Based

- Sustainable/Bio-Based Resins

- Bio-degradable Bioplastics

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Polybutylene Adipate Terephthalate (PBAT)

- Non-biodegradable Bioplastics (Bio-PE, Bio-PET)

- Bio-degradable Bioplastics

- Recycled Resins

- Post-Consumer Recycled (PCR)

- Post-Industrial Recycled (PIR)

By Process Type/Structure

- Thermoplastics

- Crystalline Thermoplastics (e.g., HDPE, PP, PET)

- Amorphous (Non-Crystalline) Thermoplastics (e.g., PS, PC, PVC)

- Thermosets

- Epoxy Resins

- Phenolic Resins

- Unsaturated Polyester Resins (UPR)

- Polyurethane (PU)

By Application/End-Use Industry

- Packaging

- Rigid Packaging (Bottles, Containers, Trays)

- Flexible Packaging (Films, Bags, Pouches, Wraps)

- Industrial & Transit Packaging (Pallets, Crates)

- Construction

- Pipes, Fittings, & Conduits

- Insulation & Glazing

- Profiles & Decking

- Automotive & Transportation

- Interior Components (Dashboards, Trims)

- Exterior Components (Bumpers, Lighting)

- Under-the-Hood Components

- Electrical & Electronics (E&E)

- Wire & Cable Insulation

- Housings & Casings

- Connectors & Components

- Consumer Goods

- Appliances

- Toys & Sporting Goods

- Furniture & Housewares

- Medical & Healthcare

- Disposables (Syringes, Bags)

- Devices & Equipment Casings

- Pharmaceutical Packaging

- Textile & Clothing (Synthetic Fibres)

- Agriculture (Films, Irrigation, Containers)

By Manufacturing Process

- Injection Molding

- Extrusion

- Blow Molding

- Thermoforming

- Rotational Molding

- Compression Molding

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6070

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.